Ms Nirmala Sitharaman, Finance Minister, Government of India, spoke of the focus of the Union Budget 2026-27 calling it a unique Yuva Shakti driven Budget with the Government’s Sankalp to focus on the poor, underprivileged and the disadvantaged. Being first Budget prepared in Kartavya Bhawan, the Hon’ble Minister mentioned being inpired by 3 kartavya as follows:

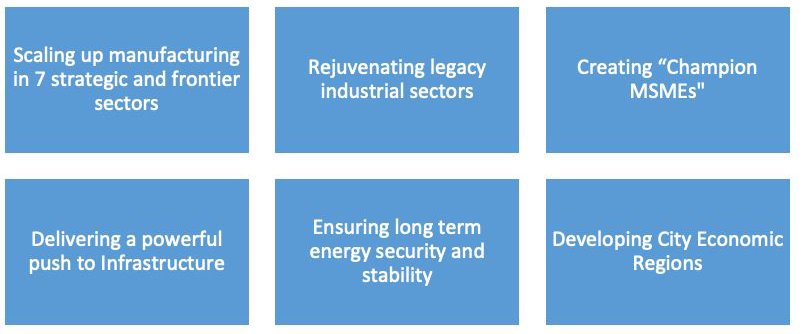

- The first kartavya is to accelerate and sustain economic growth, by enhancing productivity and competitiveness, and building resilience to volatile global dynamics.

- The second kartavya is to fulfil aspirations of the people and build their capacity, making them strong partners in India’s path to prosperity.

- The third kartavya, aligned with the vision of Sabka Sath, Sabka Vikas, is to ensure that every family, community, region and sector has access to resources, amenities and opportunities for meaningful participation.

The Finance Minister stated that the threefold approach required a supportive ecosystem. The first requirement would be directed to sustaining the momentum of structural reforms— continuous, adaptive, and forward-looking. Second, a robust and resilient financial sector was central to mobilising savings, allocating capital efficiently and managing risks. Third, cutting edge technologies, including AI applications, could serve as force multipliers for better governance.

Figure 1 Budget is inspired by 3 Kartavya in Union Budget 2026-27

Figure 2 Requirement is to sustain the momentum of structural reforms

Source: Union Budget 2026-27, https://www.indiabudget.gov.in/, accessed on February 1, 2026

Figure 3 Interventions in six areas to accelerate and sustain economic growth in the First Kartavya

Source: Union Budget 2026-27, https://www.indiabudget.gov.in/, accessed on February 1, 2026

As India advances towards a Viksit Bharat, the three kartavya articulated in the Union Budget provide a clear context for the Nation’s growth and aspirations, combining economic momentum with capacity building and inclusive progress. The Cement Manufacturers’ Association (CMA) appreciates the Union Budget 2026-27 for the continued emphasis on manufacturing competitiveness, urban development and infrastructure modernisation, supported by over 350 reforms spanning GST simplification, labour codes, quality control rationalisation and coordinated deregulation with States. These reforms, alongside the Budget’s focus on Youth Power and domestic manufacturing capacity under Atmanirbharta, stand to strengthen the investment environment for capital intensive sectors such as Cement. The Union Budget 2026-27 reflects the Government’s focus on infrastructure led development emerging as a structural pillar of India’s growth strategy.

As India advances towards a Viksit Bharat, the three kartavya articulated in the Union Budget provide a clear context for the Nation’s growth and aspirations, combining economic momentum with capacity building and inclusive progress. The Cement Manufacturers’ Association (CMA) appreciates the Union Budget 2026-27 for the continued emphasis on manufacturing competitiveness, urban development and infrastructure modernisation, supported by over 350 reforms spanning GST simplification, labour codes, quality control rationalisation and coordinated deregulation with States. These reforms, alongside the Budget’s focus on Youth Power and domestic manufacturing capacity under Atmanirbharta, stand to strengthen the investment environment for capital intensive sectors such as Cement. The Union Budget 2026-27 reflects the Government’s focus on infrastructure led development emerging as a structural pillar of India’s growth strategy.